International shipping can be a jungle.

Easier international shipping

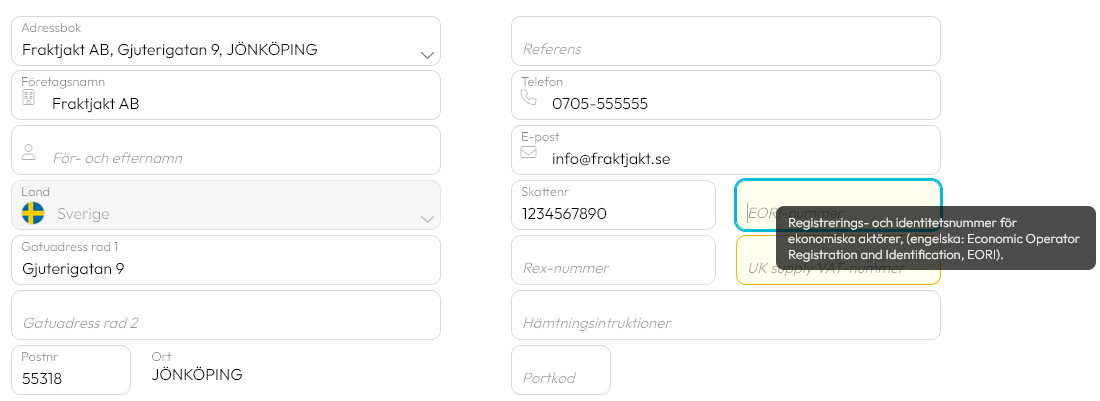

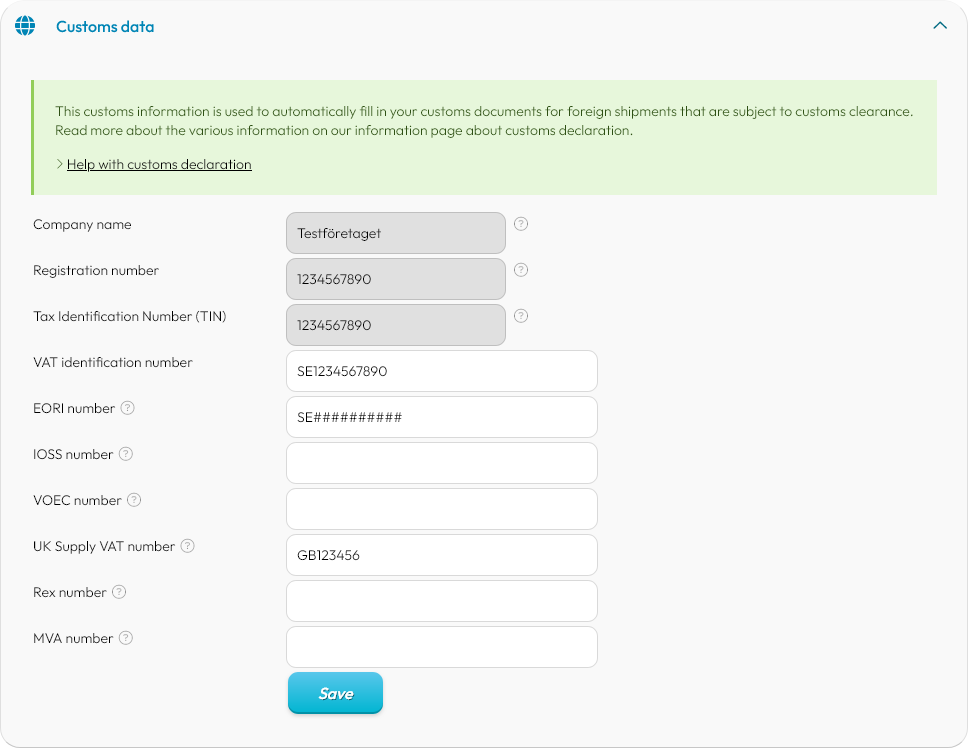

We not only guide your shipping creation by looking up addresses, place names, shipping services and nearest agents, but also convey information and experience from our ever-growing knowledge bank about shipping to all countries in the world. Each region and country has its own notices with information about the risk of possible customs duties as well as goods and packaging materials that previous customers had problems with.We also guide you with basic information about terms such as Eori, IOSS, VOEC, VAT, EKAER, MVA, UK supply VAT, TIN, REX, HS commodity codes, Taric, UN and when they are needed for your customs documents, as well as which regions they are applicable to, if so for the EU, EEA, GSP, OCT and other free trade agreements.

Automatic information from matched addresses

If an address is sent through your order links that match one of your addresses to your address register, they will be automatically supplemented with other shipping information. Such as mobile numbers and telephone numbers for notification, as well as directions, port code, pick-up instructions, desired times / days and delivery instructions from the information of your saved addresses.International freight is also supplemented with necessary information such as organization number / tax number, Eori, VOEC, IOSS, VAT, EKAER, MVA, UK supply VAT, UN and Rex number.

Read more about Automatic address register.

More than just labels and waybills

Unlike simpler TMS that only create shipping labels and waybills, Fraktjakt also helps with shipping manifests, delivery notes and even fills in your customs documents for security declarations, CN22, CN23, Proforma Invoices and Commercial Invoices automatically.Fraktjakt automatically creates basic customs documents for your freight, but it is also worth noting that these are only a helpful basis in your customs handling. It is still always you in the role as the sender who is responsible for ensuring that you have received current and specific information that applies to your shipment from your national Customs agency and the shipping companies themselves. If you have no need for Fraktjakt's documents if you, for example, create your own documents, you can deactivate them so that they are not included in your collection printout and automatic printouts.

Read more about Printing of shipping documents.

Commercial Invoices

A commercial invoice is used to describe goods that are exported for sale and is an important part of the clearance process where customs authorities classify goods so that customs duties and taxes can be assessed correctly.All shipments to countries outside the European Union (EU) require customs documents, so also within the EU Customs Union, such as Cyprus, Greece, Malta, and Hungary, as well as areas outside the EU excise areas such as Åland and the Canary Islands, under certain conditions.

Correct and complete information on a commercial invoice is very important to get fast and problem-free customs processing. Most shipping companies require a commercial invoice in three copies, all individually signed. Two copies, you put a place pocket attached to the outside of the goods and a copy that you put inside the goods.

Fraktjakt automatically creates a basic commercial invoice for your freight with the most common information pre-filled. However, it is still your responsibility to check that the information is correct and if any information is missing. If you wish to create your own customs documents, you can disable Fraktjakt's documents under your print settings. Be aware that some countries sometimes do not accept handwritten commercial invoices. If the document is not correct, the shipment may be stopped by the receiving customs or the shipping company's customs agent. Fraktjakt will then invoice for the additional costs that may arise.

The signature does not have to be original and in Fraktjakt you can upload your signature so that it is filled in automatically.

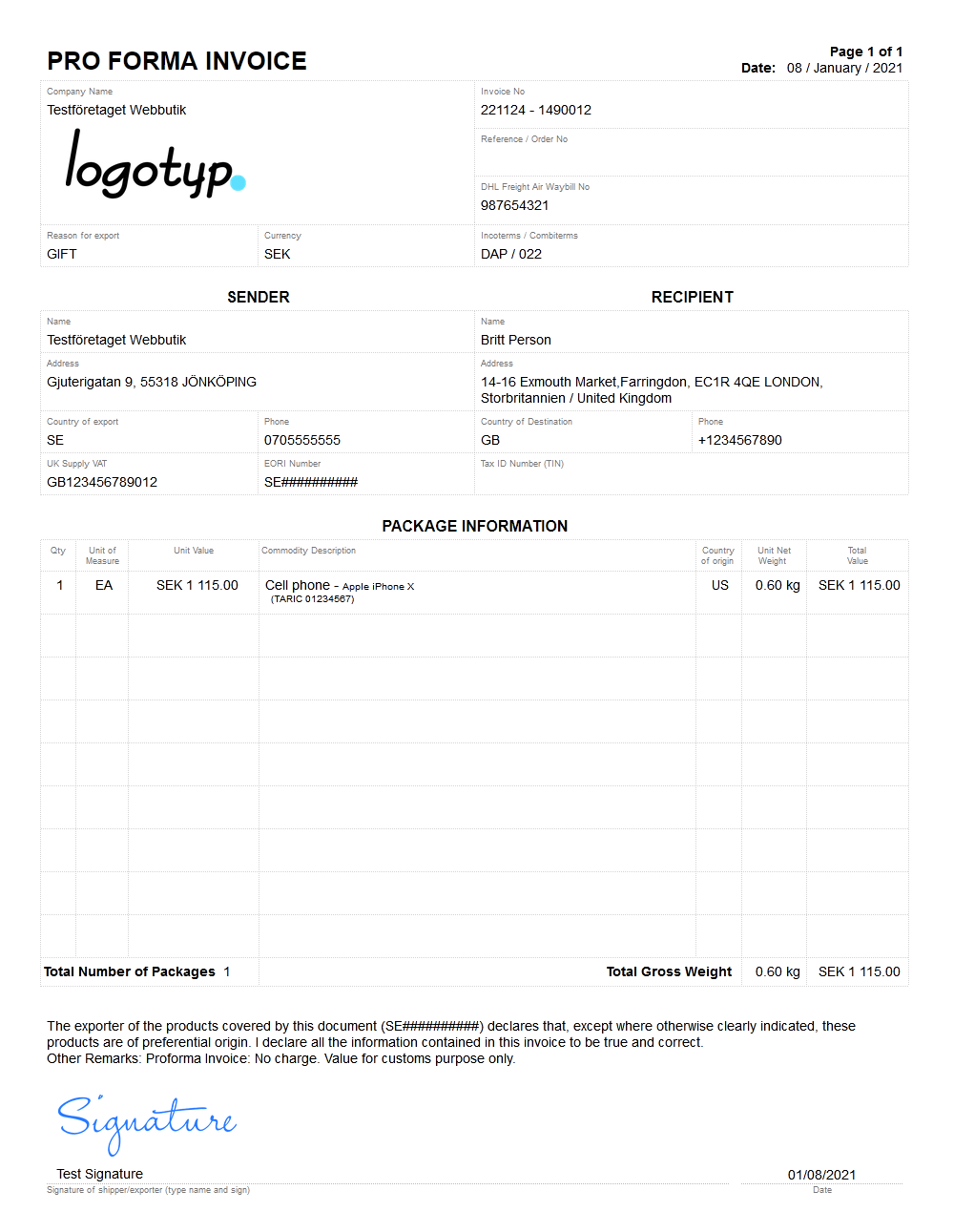

Proforma Invoices

A proforma invoice is used instead of a commercial invoice if the importer has not bought the product. That is, if the product is not for sale, for example for gifts, samples, returns and repairs. The proforma invoice is an important part of the clearance process where customs authorities classify goods so that customs duties and taxes can be assessed correctly.All shipments to countries outside the European Union (EU) require customs documents, so also within the EU Customs Union, such as Cyprus, Greece, Malta, and Hungary, as well as areas outside the EU excise areas such as Åland and the Canary Islands, under certain conditions.

Correct and complete information on a customs document is very important to get a fast and problem-free customs processing. Most shipping companies require a proforma invoice in triplicate, all individually signed. Two copies, you put a place pocket attached to the outside of the goods and a copy that you put inside the goods.

Fraktjakt automatically creates a basic pro forma invoice for your freight with the most common information pre-filled. However, it is still your responsibility to check that the information is correct and if any information is missing. If you wish to create your own customs documents, you can disable Fraktjakt's documents under your print settings. Be aware that some countries sometimes do not accept handwritten commercial invoices. If the document is not correct, the shipment may be stopped by the receiving customs or the shipping company's customs agent. Fraktjakt will then invoice for the additional costs that may arise.

The signature does not have to be original and in Fraktjakt you can upload your signature so that it is filled in automatically.

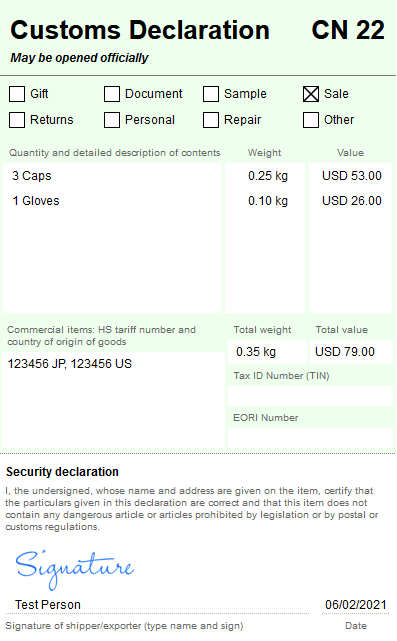

Customs declaration CN22

CN 22 is a simplified customs declaration for letter items with a value of up to SEK 2,000 which also includes a security declaration. Paste CN22 directly on the item, completely flat without folding over an edge.All shipments to countries outside the European Union (EU) require customs clearance. No customs clearance is required for goods shipped within the EU, with the exception of Cyprus, Greece, Malta, and Hungary, as well as areas outside EU excise areas such as Åland and the Canary Islands.

Correct and complete information on a customs document is very important for fast and hassle-free customs processing.

Fraktjakt automatically creates CN22 and several other basic customs documents pre-filled with the information about your freight. However, it is still your responsibility to check that the information is correct and if any information is missing. If you wish to create your own customs documents, you can deactivate Fraktjakt's documents under your print settings. If the document is not correct, shipping may be stopped by the receiving customs office or the shipping company's customs agent. Fraktjakt will then invoice for the additional costs that may arise.

Customs declaration CN23

CN 23 is a customs declaration for all postal parcels and for letter items over SEK 2,000 that include a security declaration. CN 23 also applies to postal parcels and letter items under SEK 2,000 that are sent for commercial purposes. Tape the document directly on what you are to send or insert plastic pocket that you attach to the shipment.All shipments to countries outside the European Union (EU) require customs clearance. No customs clearance is required for goods shipped within the EU, with the exception of Cyprus, Greece, Malta, and Hungary, as well as areas outside the EU excise areas such as Åland and the Canary Islands.

Correct and complete information on a customs document is very important for fast customs processing. Most shipping companies require customs documents with three copies, all individually signed. They also recommend that you add an extra copy to the package.

Fraktjakt automatically creates CN23 and several other basic customs documents pre-filled with the information about your freight. However, it is still your responsibility to check that the information is correct and if any information is missing. If you wish to create your own customs documents, you can deactivate Fraktjakt's documents under your print settings. If the document is not correct, shipping may be stopped by the receiving customs office or the shipping company's customs agent. Fraktjakt will then invoice for the additional costs that may arise.

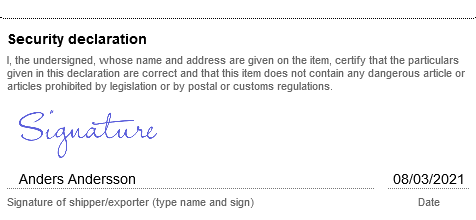

Security declaration

When sending postal items within the EU, a security declaration must be attached to the shipment. Paste this label to the shipment.Fraktjakt automatically creates the security declarations required for your shipment.

Prohibited content

It is forbidden to send the following items:- Batteries or items containing batteries (due to the risk of fire);

Due to increased safety concerns in the aviation industry, ICAO / IATA regulations for the transportation of lithium batteries have been tightened and airlines must therefore comply more closely with these regulations. - Compressed, condensed gases, such as fire extinguishers, lighters and aerosol sprays;

- Flammable and explosive materials, such as solvents, paints, cleaning agents, varnishes, gasoline, pyrotechnic materials, etc.;

- Oxidized substances and organic peroxides, such as hair and textile paints, bleaches, adhesives;

- Toxic, corrosive, contagious or radioactive substances;

- Other hazardous substances, such as anesthetics and chemicals that cause strong discomfort when leaked;

- Strong magnetic materials;

- Alcoholic drinks or tobacco;

- Medicines or drugs;

- Goods that require cooling or heating;

- Dead or live animals (with few exceptions), human remains or ashes;

- Precious items, such as gold, silver, gems, coins, bank notes and securities;

- Weapons, weapon parts or replicas.

Most shipments of batteries are stopped immediately at the security check, and you may be charged for violations of these rules. The ban on batteries includes all items that contain batteries, such as computers, mobile phones, screwdrivers, and other electronic items. For smaller shipments, there may be special exceptions to the ban, but if you do intend to send an item containing a battery you must verify strict compliance with the current terms and conditions of your chosen shipping company.

If a shipment contains food, the manufacturer and the manufacturer's address must be specified.More terms can be found under each service and shipper, so read more detailed info under the terms for the corresponding service and shipper.

Dangerous goods

Dangerous goods are substances that may pose a risk to health, safety, property or the environment when it is transported or used, or which the carrier categorizes as dangerous goods. More information on dangerous goods can be provided by the MSB - The Swedish Agency for Social Protection and Emergency Preparedness.

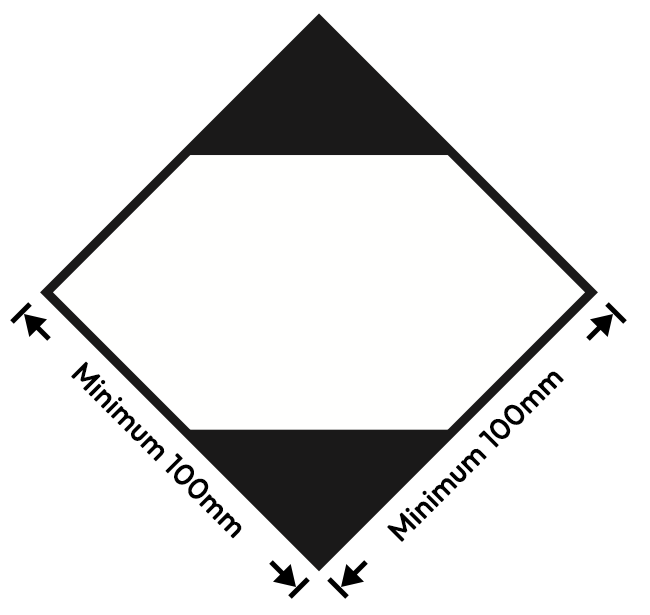

Exemption for Transport of Dangerous Goods in Limited Quantities (LQ)

Certain types of dangerous goods may be shipped as "Limited Quantity" (LQ) provided that the transport complies with ADR rules for LQ. To ship LQ with Fraktjakt, your company must first be approved by us. Please contact our sales team to have your company reviewed and approved. The sender is responsible for ensuring that all labeling, packaging, and any required documentation complies with ADR requirements.Read more about Prohibited and dangerous content.

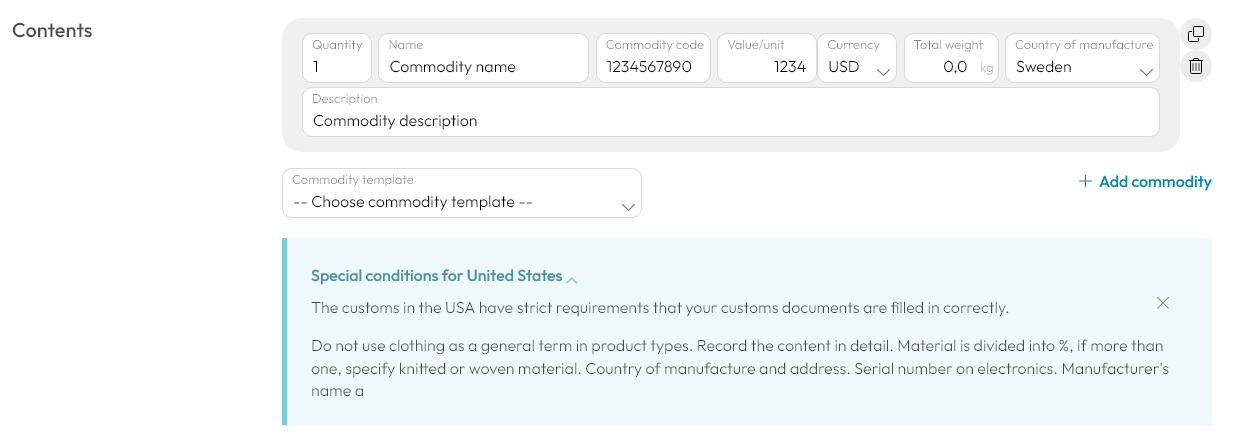

Commodity description for customs declaration

The customs departments may require information about material, properties, purpose etc.

This should not be your sales text from your online store, but a brief description of the product's characteristics that are relevant for customs processing.

The description should answer the following questions:

- What is it?

- What materials is the item made of?

- What is the item used for?

Use a language understood in the destination country.

In the case of clothing, the material needs to be stated in percentage, for example 'Women's 100% Cotton T-Shirt'.

See the following link for more examples; https://www.cbp.gov/trade/basic-import-export/e-commerce/examples-unacceptable-vs-acceptable-cargo-descriptions

For entry into the EU Customs Union, a customs description is required according to ICS2. See the link for examples; https://taxation-customs.ec.europa.eu/system/files/2021-03/guidance_acceptable_goods_description_en.pdf

The commodity name + description must include at least 15 characters together.

If you are unable to enter a custom customs description in your e-commerce system, our Intelligent commodity templates can be used to automatically match and replace the customs description in Fraktjakt.

Proper customs clearance with commodity codes

Commodity codes (also called tariff codes, taric codes and hs codes) are usually not required, but speeds up and improves the customs process which enables a faster delivery and may avoid unnecessary charges or that your shipments get completely stuck or refused in customs.With our Intelligent commodity templates you can supplement your shipments with correct item codes automatically, by either retrieving information from previous shipments and thus learning and automatically creating new templates from previous shipments or manually adding the information you want to complete future shipments with.

More information at your Customs agency

Fraktjakt's system automatically informs about the most common tasks required for the import and export of goods. We also create the most common customs documents for your shipments automatically together with other shipping documents.Our customer service is happy to help you if something is still unclear, so also the shipping companies you bought the shipping through, but you get the most current and specific information for your particular shipping via your own national Customs agency.

There you can also look up the product codes for your goods and see exact terms and tax rates that apply to them to your receiving country.

https://www.tullverket.se/foretag/internationellhandel/klassificeravaror

Svenska

Svenska English (US)

English (US)

English (US)

English (US)

Svenska

Svenska